Article Source: CERES

This year has tested the resilience of UK growers, who have navigated challenging weather, financial pressures, and logistical hurdles to bring in the 2024 harvest. While pre-arranged contracts have provided some stability, escalating costs and unpredictable market conditions continue introducing new risks.

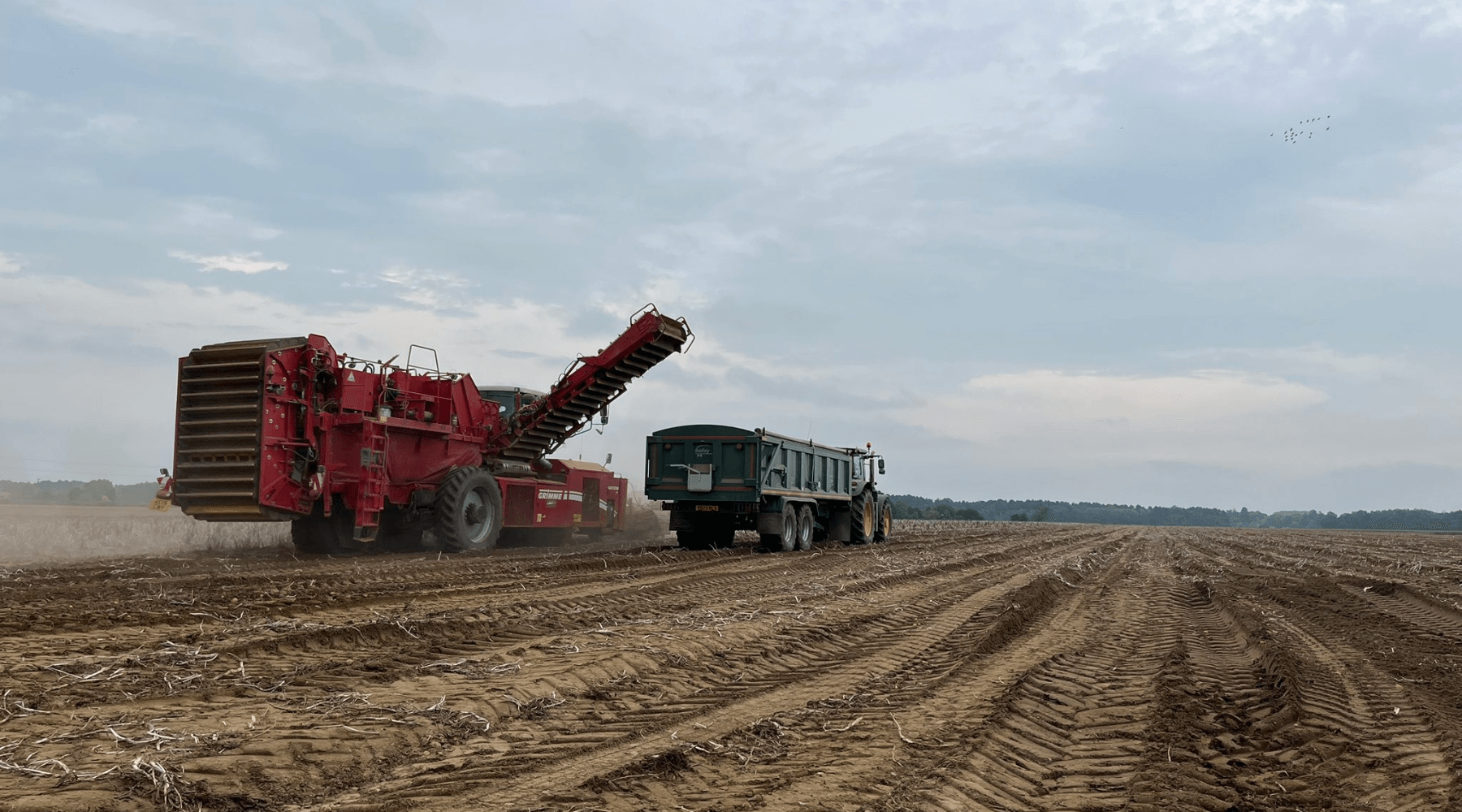

Image Source & Credit – Jon Rooke

Key Facts:

- Weather Impacts: Ideal growing conditions early on, followed by a severe dry spell in July and August, and then excessive rain.

- Yield and Quality: Mixed outcomes in yield and quality, with high dry matter content but smaller tubers across many regions.

- Pests and Diseases: High blight pressure requires increased spraying; other diseases like Rhizoctonia and Blackleg (see below) affected shape and quality, particularly in early-planted crops.

- Financing: Financing costs have risen, with interest rates now at around 7% compared to 1.7% in recent years.

- Market Prices: Potato prices are trending £15-£80 per tonne higher than last season; Chip shop prices are projected to reach £20 per 25kg bag by spring 2025 due to tighter supplies.

Weather and Growing Conditions

Weather extremes have dominated the season, resulting in inconsistent yields and complicated regional harvests. Jon Rooke, a grower based in York, shared that conditions were near perfect until late July, when a sudden dry spell lasting into August sapped moisture from the soil, affecting potato sizing and yield. This particularly impacted his crisping potato varieties, which require stable moisture levels to maintain high quality. “We went from praying for rain to dealing with extreme wetness,” Rooke reflected, a sentiment many in the east echoed.

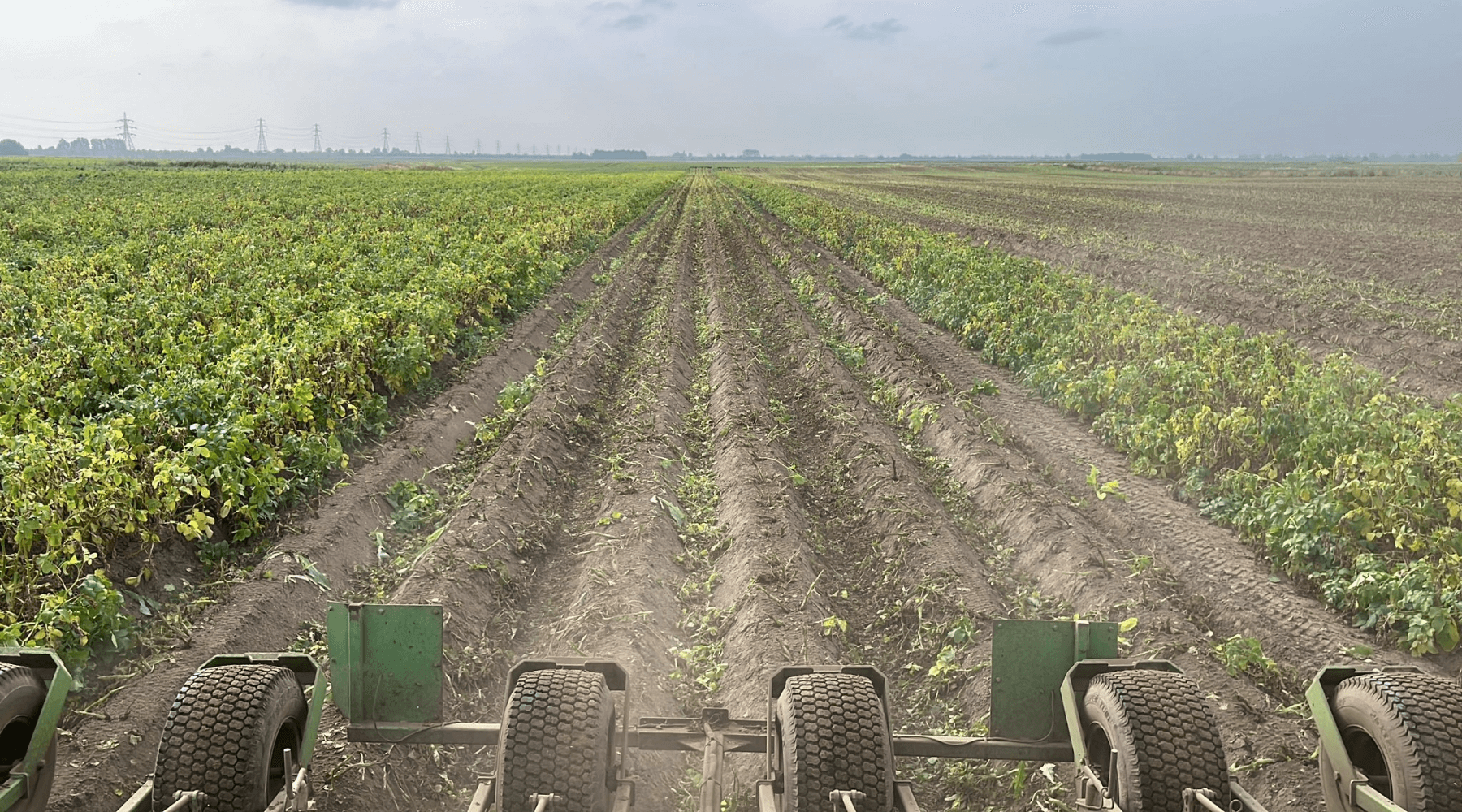

Further south, Patrick Clabon of HG Bliss Farms near Downham Market noted that excessive rainfall from late 2023 to early spring left fields waterlogged and delayed planting. This delay reduced soil structure, forcing farmers to “push the crop in” (plant the crop under less-than-ideal soil condition) and resulting in smaller tubers and less ideal conditions for crop development. For those growing chipping potatoes, the delayed planting combined with an uncharacteristically dry June and dull July further restricted growth, leaving Clabon’s crop about 500 tonnes short of expectations.

Terry Jones, UK Sales Manager for Meijer Seed Potato Limited, observed a similar impact on seed potatoes, with delays in planting of up to eight weeks in some areas. While early crops fared better, those planted later were stunted by the dry weather, leading to small tuber sizes and reduced yield potential. Jones noted that growers in the western regions, who benefited from more consistent rainfall, produced better-sized tubers. However, harvesting in these areas has become challenging due to wet soil conditions.

Pests, Diseases, and Crop Quality

In addition to weather concerns, growers faced heightened pest and disease pressures this year. Rooke described 2024 as an “incredibly tough blight year,” noting that spraying frequency increased to once a week, with some crops requiring double the amount of chemicals. This aggressive approach was necessary to manage blight outbreaks, which thrive in humid conditions and can devastate crops if untreated. The increased frequency of spraying led to significant rises in chemical costs, adding another financial strain.

John Bones, Commercial Director at R.S. Cockerill, reported that Rhizoctonia (see below)—an emerging issue in early-planted crops—had caused a noticeable impact on tuber shape and consistency, resulting in what he called “leaders,” or misshapen tubers. This issue, while not as severe as blight, presented challenges for processing potatoes, where uniform shape is essential for quality control.

Image Source & Credit – Mitchell Potatoes Lorry

Evie Coggon from Isle of Ely Produce highlighted the prevalence of blackleg, which affected several crops toward the season’s end, likely due to the late wet weather. Pests continue to be a challenge across the industry. Coggon emphasises the need for sustainable land management and crop diversification to control pest pressures. “Land sustainability is essential,” she stated, underscoring the importance of research into alternative pest-control methods, including innovative cover cropping techniques.

Overall, the quality of the 2024 crop is highly variable. While crisping potatoes from Cockerill’s farms reported high tuber counts suitable for processing, the dry summer increased dry matter content, making them prone to bruising—a critical issue for potatoes destined for long-term storage. Clabon observed similar quality issues, noting that his chipping potatoes, usually around 110-count per bag, are smaller this year, with bags closer to 140–150 counts. This shift may necessitate adjustments in portion sizes and customer expectations for chip shops.

Image Source & Credit – Jon Rooke

Production Costs and Market Conditions

Rising input costs have placed additional pressure on growers, especially as they face the financial burden of machinery, labour, and fuel price increases. Fertilisers, though fluctuating, remain high, and fuel costs have seen only marginal improvements. For growers like Clabon, financing costs have surged, with interest rates at around 7% compared to just 1.7% a few years ago. This increase has turned long-term investments in crops like potatoes into a more costly proposition, especially as market prices remain unpredictable.

According to Stuart Mitchell of Mitchells Potatoes, machinery costs have become a significant barrier, with some harvesters priced at nearly £1 million and tractors around £250,000. These high costs make it challenging for smaller farms to remain competitive. Seed potato prices are also rising due to limited high-quality land availability. Jones noted that finding suitable land for seed production is becoming increasingly difficult in the UK, as in northwestern Europe.

Image Source & Credit – Patrick Clabon

Many growers managed some price stability by securing contracts before planting. Clabon’s contracts with McCain provide a buffer against market swings, though growers without such agreements faced more volatility. In the open market, early prices dropped sharply as crops initially flooded the market but later stabilised as supply concerns surfaced due to harvest delays. Mitchell highlighted that this year’s potato prices are trending £15-£80 per tonne higher than last season, reflecting tighter supply but still within reasonable bounds for most processors.

Labour, Harvest, and Logistical Challenges

Labour shortages and challenging harvest conditions created logistical difficulties for many growers. Heavy soils slowed down harvesting machines, particularly in Cambridgeshire and Lincolnshire. Jones shared an instance where a farm equipped with three harvesters only managed to lift 250 tonnes daily—a fraction of their usual capacity due to wet soils clogging machinery and slowing operations.

Storage capacity has also become a pressing issue, especially given high energy costs. Coggon noted that many growers hesitate to commit to long-term storage without indicating higher prices later in the season. This has forced some to sell their crop early. In contrast, others juggle which batches to store in temperature-controlled environments to maximise potential profits. Growers also contend with transportation bottlenecks, as finding qualified drivers and available trucks has become increasingly challenging.

Image Source & Credit – Mitchell Potatoes Lorry

Market Outlook

The market outlook 2024 is a mixed picture of supply and demand stability with underlying pressures. Potatoes’ high dry matter content could impact fry quality for the fresh chip market, potentially limiting available supplies. Bones suggested that while crisping varieties might fare better due to higher tuber counts, the fresh market may experience tighter supplies if processors divert stocks from the fresh chip sector. For the seed potato market, Jones warned that limited land for seed production could impact future availability, putting further strain on an already pressured supply chain.

Coggon expressed concerns about declining grower numbers, observing that smaller growers are increasingly unable to absorb the financial risks associated with potato farming. “The number of potato farmers is declining yearly,” she noted, citing the escalating costs and the need for sustainable business models. This sentiment is echoed by Clabon, who worries about a shrinking potato acreage over the next 10-20 years, especially if current economic pressures continue without supportive measures to retain new and existing growers. As Clabon sees it, achieving balance in the potato market requires collaboration between growers and chip shop owners. He stressed the importance of mutual understanding: “There’s a great distrust, but we all need to work together. Growers must cover costs without overburdening the consumer.”

Image Source & Credit – Isle of Ely Produce

Future Considerations

Beyond immediate market dynamics, industry experts are considering long-term changes to UK potato farming. Bones highlighted that environmental and economic pressures could push growers toward more resilient and efficient varieties. At the same time, Coggon advocated for enhanced research into sustainable farming practices to address evolving pest and disease challenges. As machinery, land, and financing costs continue to climb, the potato industry may shift toward larger-scale operations or increased reliance on imports unless conditions improve for domestic growers.

Blackleg: A bacterial disease that causes blackening and rotting of the potato stem, leading to stunted growth, wilting, and sometimes total crop loss.

Blight: A fungal-like disease (often Phytophthora infestans) that causes dark spots and rotting on leaves, stems, and tubers, spreading rapidly in wet, humid conditions and potentially devastating potato crops if untreated.

Rhizoctonia: A fungal disease that causes black scurf on potato tubers and can lead to misshapen and uneven tubers, affecting quality and marketability.